Jeśli ktoś ma szukać listy najlepszych na świecie brokerów walutowych, Avatrade z pewnością pojawi się obok najpopularniejszych firm brokerskich. Chociaż tak jest, opinie na temat brokera nie zawsze są pozytywne. Wyszukiwanie w sieci sprawi, że negatywne recenzje Avatrade będą opisywały platformę jako oszustów. Chociaż te oceny wskazują na ich złe doświadczenia handlowe z Avatrade, inwestorzy powinni ocenić firmę osobiście. Pozwoli to inwestorom ocenić, czy Avatrade jest w pełni godny inwestycji.

Avatrade jest firmą giełdową z siedzibą w Irlandii. Założona w 2006 roku, dostarcza 250 instrumentów handlowych, które można wykorzystać do zwiększenia rentowności handlu. Dzięki sprawdzonej efektywności i optymalnej techniczności, Avatrade zyskał około 200.000 klientów z całego świata. Wszystko to jest możliwe, ponieważ pozostają one wierne swojej misji zapewnienia inwestorom najlepsze doświadczenie rynkowe i poprzez zapewnienie idealnej platformy przewodowej z najbardziej korzystnych funkcji. Ponadto, podtrzymują oni swoją misję poprzez zapewnienie silnego bezpieczeństwa Avatrade, który utrzymuje wszystkie finanse klientów bezpieczne i pozbawione finansowego wytarcia.

Po latach ekspansji udało jej się stworzyć odpowiednie biuro w Paryżu, Mediolanie, Tokio, Madrycie i Sydney. W miarę dalszego rozwoju działalności firmy, liczba jej klientów stale rośnie. Duża baza klientów Avatrade pozwala im na obsługę milionów transakcji miesięcznie. Wszystkie te transakcje są realizowane w sposób przejrzysty poprzez zaawansowany system. Z tego powodu Avatrade zdobył prestiżowe uznanie w dziedzinie finansów.

Wiarygodność Avatrade

Licencje są niezbędne, ponieważ są one oznaką pozycji firmy. Licencja świadczy o legitymizacji firmy. Ponadto ma ona świadczyć o tym, że firma przeszła intensywne kontrole i spełniła wszystkie kryteria określone przez organ. Jeśli chodzi o Avatrade, uzyskała ona licencję od Bank of Ireland i jest spółką regulowaną zgodnie z rozporządzeniem w sprawie aktywów klientów. Można zapewnić, że jej transakcje są oparte na podstawach prawnych, ponieważ firma posiada również pozwolenia na działalność i certyfikaty od Australijskiej Komisji Papierów Wartościowych i Inwestycji (ASIC), Południowoafrykańskiego Dostawcy Usług Finansowych (FSP) i Japońskiej Agencji Usług Finansowych (FSA).

Rodzaje rachunków

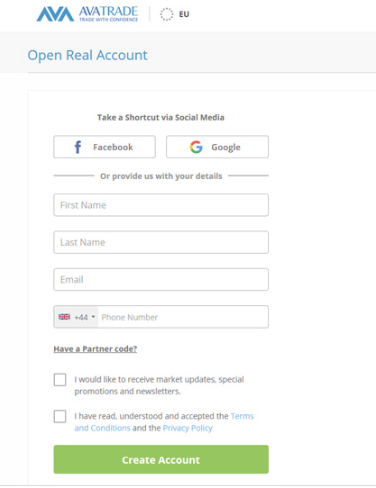

Otwarcie konta w Avatrade jest łatwe. Klient musi tylko wypełnić formularz zgłoszeniowy dostępny na stronie internetowej Avatrade. Po jego wypełnieniu zostanie on poddany weryfikacji tożsamości w celu przejścia do kolejnego kroku. W tym procesie klienci są proszeni o dostarczenie dokumentów, w tym ważnego dowodu tożsamości i rachunku za media pod nazwą wnioskodawcy. Będzie to podstawą do stwierdzenia, czy dana osoba jest uprawniona do otwarcia konta w Avatrade. Po pomyślnej walidacji, klienci otrzymają oficjalny login do Avatrade wraz z hasłem.

Należy pamiętać, że przed założeniem konta, klient będzie musiał zdecydować, jaki rodzaj konta chce zasubskrybować. Typy kont Avatrade są standardowe, korporacyjne, islamskie i profesjonalne. Tak jak w przypadku innych domów maklerskich, Avatrade oferuje konto demo tylko wtedy, gdy użytkownik chce przetestować i ocenić ogólną funkcjonalność platformy.

- KONTO STANDARDOWE – Osoba fizyczna jest właścicielem tego konta, a właściciel ma prawo do wybranych narzędzi i instrumentów handlowych. Za minimalną wpłatę Avatrade w wysokości $100 (karty kredytowe/debetowe) i $500 (przelewy bankowe), można zarobić używając kontraktu na handel różnicami i inne ustawienia handlowe.

- RACHUNEK KORPORACYJNY – Instytucja prawna jest właścicielem tego typu rachunku. Jeśli ktoś chce otworzyć rachunek firmowy, musi przejść bardziej intensywny proces weryfikacji. Weryfikacja w ramach tego typu rachunku obejmuje dokumentację taką jak Uchwała Rady Nadzorczej, Świadectwo Założycielskie, Rejestr Wspólników i inne.

- KONTO ISLAMICZNE – Ten rodzaj konta jest zgodny z islamskim prawem szaratu. Tak jak to ma miejsce, to konto nie oferuje handlu kryptowalutami i niektórych instrumentów walutowych. Konto to oferuje również wyższy spread dla par walutowych w porównaniu z innymi rodzajami kont.

- RACHUNEK PROFESJONALNY – Jest to specjalny rodzaj rachunku, który pozwala inwestorom korzystać z dźwigni finansowej pre-ESMA. Aby otworzyć rachunek profesjonalny, klient musi spełnić minimum dwa z trzech kryteriów. Aby określić, czy dana osoba kwalifikuje się do tego rachunku premium, portfel finansowy jest poddawany ocenie. Ocenia się w ten sposób całkowitą liczbę zawartych transakcji oraz to, czy klient posiada doświadczenie w sektorze finansowym.

Avatrade nie tylko jest wyposażony w szerokie opcje konta, ale także wykorzystuje wiele platform handlowych, z których użytkownicy mogą wybierać. Ponieważ firma ma na celu zapewnienie personalizacji i wydajności razem, to okablowane jego system, który pozwoli handlowcom dostosować swoją własną platformę zgodnie z ich preferencjami. AvaTradeGo, DupliTrade, ZuluTrade i MT4 to tylko niektóre z wielu platform oferowanych przez firmę. Ponadto, inwestor nie musi martwić się o problemy z kompatybilnością, ponieważ wszystkie platformy posiadają wersje android i iOS, z których wszystkie mogą być pobierane za pomocą smartfonów lub komputerów.

Wpłata i wypłata środków

Legitymacja brokerów walutowych przejawia się w tym, jak skuteczny i wygodny jest zwrot finansowy. Subskrypcja w tej firmie wymaga minimalnego depozytu Avatrade w wysokości 100 dolarów i może być zdeponowana za pomocą różnych metod, takich jak przelewy bankowe, portfele elektroniczne i karty kredytowe/debetowe. Transakcje wpłaty mogą trwać maksymalnie 5 godzin, zanim gotówka odbije się na koncie osobistym.

Wycofanie może być wykonane przy użyciu tych samych metod. Wypłata przy użyciu kart kredytowych lub debetowych może trwać do 1 dnia; znacznie szybciej niż w przypadku innych brokerów. Najciekawsze jest to, że nie obciąża klientów żadną opłatą za wpłatę lub wypłatę, co stało się jedną z zalet brokera w porównaniu z innymi firmami.