Price Rate of Change to oscylator, który obserwuje cenę, gdy rośnie, spada lub utrzymuje tę samą prędkość. PROC może być pozytywny, gdy ROC jest silny, ceny mają tendencję do wzrostu, a negatywny, gdy ROC jest słaby, a ceny mają tendencję do spadku. Dzisiaj będziemy rozmawiać o najlepszych strategiach w zakresie tempa zmian.

RoC i średnia krocząca (Moving Average)

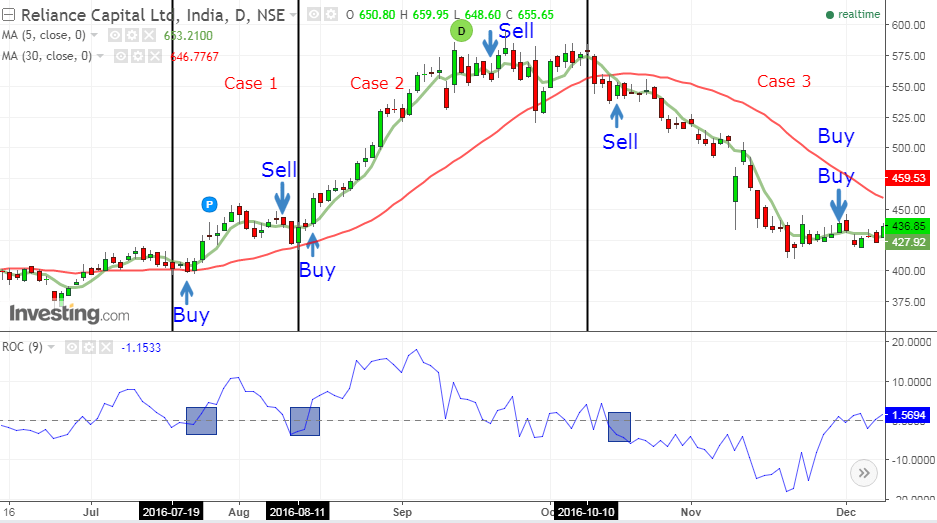

Na początku musimy uzyskać dokładny sygnał. Można to zrobić przy użyciu 5 i 30 MA i ROC. Używając ich razem, dostaniesz najlepszy czas na wejście do każdej transakcji.

Przeczytaj więcej na ten temat: Stopa zmiany (ROC) dla handlu Forex.

Spójrz na zdjęcie powyżej. Jak widać, gdy 5 DMA jest powyżej 30 DMA lub gdy ROC jest wyższy niż linie zerowe, najlepszą opcją jest pójście na długi handel. Oto kilka szczegółów na temat tej strategii.

- W “Przypadku 1” inwestor zajął długą pozycję na 410, gdy zobaczył, że ROC ma wyższy poziom niż linie zerowe. Zdecydował się zrezygnować w 440 roku po tym, jak ROC spadł poniżej linii zerowej. W sumie osiągnął zysk w wysokości 30 punktów.

- W “Przypadku 2” inwestor zauważył sygnał do kupna na pozycji 450. Jak widać, ROC jest wyraźnie wyższy niż linie zerowe, a 5 MA jest powyżej 30 MA. O poziomie 560, ROC spadł poniżej linii zerowych, a handlowiec wyszedł.

- W “przypadku 3”, na poziomie 550, ROC znajdował się poniżej linii zerowej, a 5 MA było poniżej 30 MA. To stworzyło sygnał do sprzedaży. Na poziomie 440, pozycja została ponownie rozdzielona.

Chociaż taki styl handlowania wymaga czasu, jest w stanie przynieść przyzwoite zyski.

Przerwy w handlu

Ta strategia dotycząca tempa zmian jest dość ryzykowna. Jeśli zrobisz wszystko poprawnie, okaże się, że to naprawdę satysfakcjonujące. Wyboje pojawiają się, gdy cena łamie poziom wsparcia lub oporu. To wtedy powinieneś handlować.

Przeczytaj więcej na ten temat: Jak używać wskaźnika szybkości zmian cen?

Wskaźnik ROC jest najlepszą opcją do pomiaru tego pędu. Silny impet wskazuje, że cena utrzyma pewien kierunek przez pewien czas. Możesz wykorzystać tę wiedzę, aby lepiej zaplanować swoje transakcje.

W naszej sytuacji użyliśmy 5-okresowego ROC. Mogą być stosowane inne okresy. Eksperymentuj i znajdź najlepszą opcję dla siebie. 5-okresowy ROC jest umieszczany na wykresie dziennym i pokazuje wszystkie informacje dotyczące dynamiki w cenie za poprzednie 5 dni. Należy zwrócić uwagę, że linie zerowe są całkowicie usunięte. Zamiast tego, wykreślone są poziomy +1 i -1. Jeśli ROC przekroczy +1, oznacza to, że impet jest najsilniejszy. Dostanie się poniżej -1 będzie oznaczało, że pęd jest najsłabszy. Zgodnie z notowaniami par walutowych, w tej strategii ROC, wartości mogą być zmieniane. Na przykład, zamiast używać +/-1, można użyć +/-0.25.

Następnie wykonaj te kroki:

- Ustalić zasięg;

- Spodziewajcie się wybuchu;

- Zyski.

Poniższy rysunek przedstawia załamanie na minusie. Właściwe zarządzanie pozycją pomoże Ci zmaksymalizować handel i zapewni przyszłe zyski.

Mamy nadzieję, że ta strategia Rate of Change pomoże Ci w karierze zawodowej. Używaj ich mądrze!