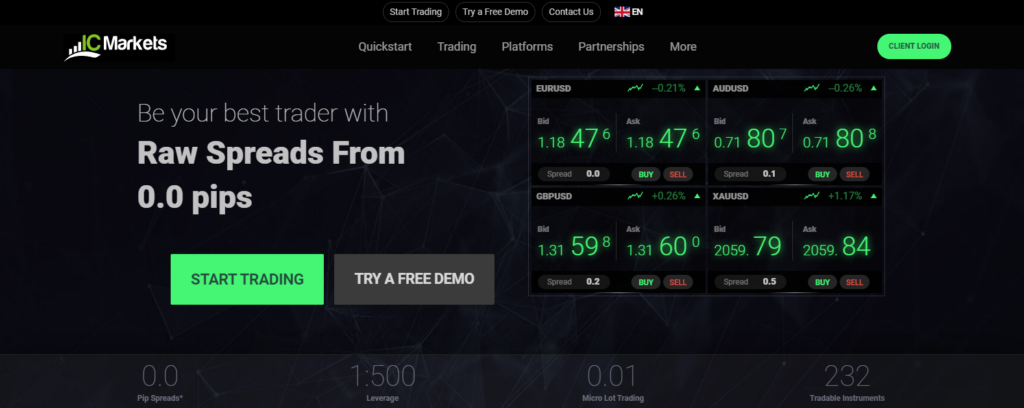

IC Markets is an online financial services provider that focuses on algorithmic trading. It offers great commission-based accounts with competitive trading conditions, albeit the limited supported markets and research tools.

IC Markets Regulation and Security

IC Markets has established itself as one of the best agency brokers offering low-latency and fast execution to scalpers and high-frequency algorithmic traders. It was founded in 2007 and produces over $15 billion worth of trading volume daily. About 500,000 trades are executed by IC Markets daily, 60% of which amount to algorithmic trades.

IC Markets operates under the regulation of the Australian Securities & Investment Commission (ASIC), a tier-1 regulatory body. It is also regulated by one tier-2 regulator, which is a lesser trusted regulator compared to ASIC. IC Markets is considered to be an average-risk broker, which still puts it above more than 50% of brokers in the market. Furthermore, IC Markets does not operate a bank nor is it publicly listed.

This broker is well known for its low-cost and scalable execution catered specifically for high-frequency algorithmic trades and complex strategies. IC Markets is also regularly praised for how it incorporates the MetaTrader platform to its features, as well as other services it offers.

IC Markets Platform Services

As already stated above, IC Markets offers great trading conditions for algorithmic traders. This broker offers both the MetaTrader and the cTrader platform suites, as well as copy-trading platforms that add to its lineup of exquisite offerings.

MetaTrader Suite

IC Markets provides both the MT4 and MT5 platforms for its traders, available in both desktop and web. Aside from security, the MT4 desktop offers the advanced trading tools package, as well as Autochartist and Trading Central. The level of sophistication brought by these add-ons takes the MetaTrader experience to a whole new level. It offers technical indicators, tools, and strategies that fit high-volume traders.

cTrader Suite

The IC Markets cTrader platform is available in both web-based and desktop versions. The cTrader suite is equipped with a vast range of trading applications, including cAlgo, which is best used for automated trading. The cTrader Copy is also available for social copy trading. However, it is important to note that the cTrader platform suite is not offered to European traders under the jurisdiction covered by IC Markets Europe.

Algorithmic Trading

IC Markets offers automated trading, though this is not possible on the cTrader and MetaTrader mobile platforms. If the trader prefers automated trading, they will have to stick with the desktop and web versions. This means that both mobile platforms are only best suited for managing existing positions or opening new trades manually.

IC Markets Trading Accounts

IC Markets only require a low deposit amount for its offered account types, applicable to both commission-based and small effective spreads accounts. IC Markets aims to stay updated with the current and best trading conditions that give users a great trading experience.

IC Markets has three account types with different trading costs, which allow traders to choose the one that fits them best. There is a commission-free standard account, which relies heavily on spreads, and two commission-based accounts, which combine both commissions and spreads for pricing.

The cTrader account has about one-tenth of a pip lower commission compared to the Raw Spread account. The main difference between the two is the trading platform available. The Raw Spread account, which offers both MT4 and MT5, charges $3.5 per side for every 100k units or $7.00 per round turn. On the other hand, cTrader is $3.0 per side or $6.00 per standard RT.

IC Markets Research and Technical Analysis

Even though IC Markets has extensive social copy-trading resources and a wide selection of platform services, research is not its strongest point. There is a glaring gap between the range of research resources offered by IC Markets compared to other industry leaders.

IC Markets joins built-in fundamental and technical analysis content on its blog. There are daily updates on its market analysis section, most suitable for traders that like to keep themselves updated with the market. However, IC Markets lacks video content, as well as quality news headlines.

IC Markets Conclusion

IC Markets has a lot of great offerings, including competitive trading conditions, sophisticated platforms, and low-cost trading accounts. However, research materials and resources are not its strongest point. Still, the security and safety offered by this broker, combined with the high-level sophistication in its overall services imply that IC Markets is a great broker to trade with.