They discover giant gaps across international locations, highlighting the important role performed by capital controls and slow-moving arbitrage capital as in Duffie (2010). Our analysis focuses on the value wedge between the spot and the futures market. We find that even inside an exchange, futures prices deviate from their theoretical arbitrage-free values. These outcomes indicate there are significant limits to arbitrage as in Gromb and Vayanos (2018) for cryptocurrencies within the early years.

- Think About a financial instrument that blends the flexibleness of spot buying and selling with the leverage of futures, however with out the constraints of an expiry date.

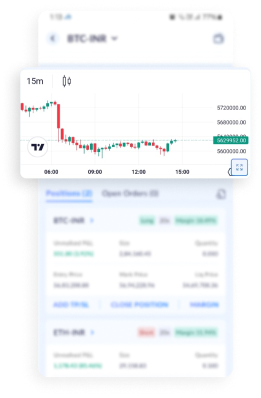

- We additionally present the visualization of all buying and selling methods beneath zero to high buying and selling costs in appendix Figure 12 to Figure 15.

- Perpetual futures play an important role in today’s crypto markets and will doubtlessly be adopted in non-crypto markets in the future.

The Way To Trade Orderly Perpetual Futures On Coolwallet

Orderly Community, the last word vacation spot for decentralized buying and selling platforms, aims to make buying and selling simple, fast, and safe for everyone. This partnership means CoolWallet customers can engage in perpetual futures buying and selling with out transferring belongings to a centralized trade, sustaining control and security over their funds. The mixture of excessive leverage and market volatility creates a big liquidation risk that may amplify losses. Moreover, their complexity may perpetual futures pose difficulties for brand new merchants, and funding charges can potentially diminish profits over longer holding periods. To guard against value drops, traders can use perpetual futures for hedging as an alternative of promoting their crypto property. Platforms that offer buying and selling on perpetual futures usually use a maker-taker fee mannequin for transaction charges.

Perpetual Futures In The Crypto Ecosystem

Since the year 2022, the deviation between the futures and the spot has turn into smaller and less volatile. We certainly find the trading technique takes much less active positions and significantly lower annualized returns. However, when there is a giant sufficient deviation, the technique can still generate sizeable Sharpe ratios in buying and selling.

During volatile market phases, high funding rates can erode profits or amplify losses. Moreover, funding charges can introduce strategic issues, the place traders could profit from holding positions that obtain payments during sustained imbalances. Like traditional futures contracts, perpetual futures are traded with margin, or leverage, which may amplify each gains and losses. That makes these contracts particularly dangerous in comparability with many other asset lessons, corresponding to shares and bonds. If a position’s equity falls below a sure threshold, it could trigger a margin call—a request from the dealer to add funds to the trader’s account or face potential liquidation of the place. Desk 10 additional stories the efficiency of the trading technique beneath completely different buying and selling prices specifications specified by Table 2.

Charges

As arbitrageurs are probably the marginal buyers in all cryptocurrency markets, their time-varying funding constraints may create widespread time-series variation in ρ𝜌\rhoitalic_ρ across completely different cryptocurrencies. Crypto perpetual futures were first launched by BitMEX in 2016, which has gained great recognition within the crypto area since its inception. It was later adopted by crypto speculators excited about leveraged publicity. Figure 1 presents the 7-day moving common of the entire buying and selling volume of perpetual futures across all exchanges. We see a big rise in buying and selling of perpetual futures around January 2021 and the total quantity stabilizes at a level above $100 billion per day following the rise.

Understanding the elemental mechanism of this financial derivative is a crucial first step for understanding speculation and hedging dynamics on this fast-evolving area. We present a comprehensive evaluation of the arbitrage and funding fee cost mechanisms that underpin perpetual futures. Empirically, the arbitrageurs face buying and selling costs when opening or terminating their positions. We can derive the no random maturity arbitrage bounds for perpetual futures.