Investment bankers are deal makers. They either work for financial institutions or smaller, independent boutique investment banking firms. Often, they work for clients from corporations that hire them when they would need to raise capital from public or private investors.

On the other hand, Forex brokers are firms that provide traders with access to a platform that allows them to buy and sell foreign currencies. Forex investing involves trade between a pair of different currencies. Most Forex broker firms handle a smaller portion of the trading volume of the overall foreign exchange market. Retail currency traders use these brokers to gain access to the 24-hour Forex market for purposes of speculation. Forex broker services are also provided for institutional clients by larger firms such as investment banks.

Over the years, Forex brokers have bettered their client services, making it simple for traders to open an account online. When opening an account, a broker would require traders to deposit money into their accounts as collateral before they start trading. However, brokers also provide leverages to their customers for them to purchase more significant amounts than what was deposited into their accounts. Leverages can depend on the country where traders are trading in where it can be 30 to 500 times the amount available in the trading account.

Best Investment Forex Brokers

Choosing the best and trusted Forex brokers to facilitate trade can be a difficult task, especially if you don’t know what to look for. The following criteria are what one should look for in a successful and secure trading session.

• Regulatory Compliance

One of the first and foremost characteristics trusted Forex brokers must-have is its credibility. Reputable brokers will often be a member of the National Futures Association (NFA) and will be registered with the U.S. Commodity Futures Trading Commission as a Futures Commission Merchant and Retail Exchange Dealer. This deters fraudulent companies from committing scams and guarantees customer security over their funds.

• Account Details and Offers

Each Forex broker has different account offerings including leverages which that can magnify your profits if used right. Another detail that Forex brokers have is its commissions and spreads. A broker makes money through commissions and spreads. Another thing to look out for is their initial deposit. Most Forex accounts can be funded with a small initial deposit than most markets. This deposit can go as low as $50 depending on the broker.

• Currency Pairs Offered

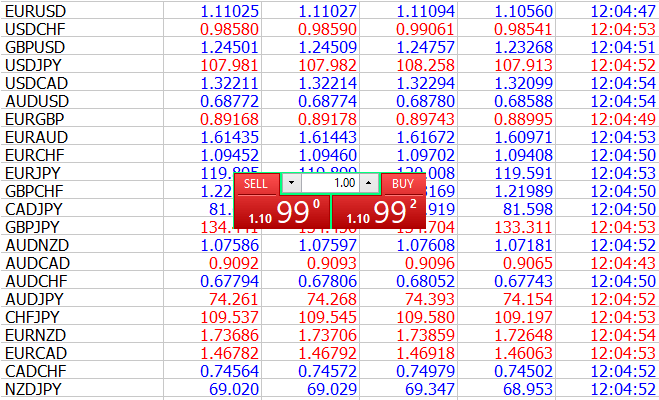

Traders can usually trade with a lot of available currency pairs, but only a few get the most attention. These pairs are traditionally called major currency pair which includes U.S. Dollar/ Japanese Yen (USD/JPY), the Euro/U.S. Dollar (EUR/USD), U.S. Dollar/ Swiss Franc (USD/CHF) and the British Pound/U.S. Dollar (GBP/USD). A broker may offer a large selection of Forex pairs. However, the most important thing to look for is/are the pair(s) in which the trader is interested in.

• Customer Service

Forex trading occurs 24 hours a day, which means most trusted Forex brokers should have 24-hour customer service. When considering a broker, it is essential to get an idea of what their customer service is like, how they would answer calls and give concise answers to the query of their customers.

• Trading Platform

Finally, a broker’s trading platform is one of the main criteria to look into as it is the trader’s portal into the market. A trusted Forex broker’s trading platform must be easy to use, has a variety of fundamental analysis tools, and is visually pleasing. A well-designed platform must have a definite ‘buy’ and ‘sell’ buttons. Otherwise, it may result in costly order entry mistakes. Most brokers also offer virtual or demo accounts, so using these can give traders an idea of how the platform works.

These are the most fundamental criteria that one should look for when choosing the best broker for Forex investing. Having confidence in the broker chosen can enable traders to devote more time and attention to analysis and to develop their strategies. Keep in mind that even trusted Forex brokers have their strengths and weaknesses, and choosing one should cater the most specific to your needs.