Founded in 2018, Axes is a young online trading site offering Contracts for Difference (CFDs) on 6 asset classes including forex, shares, spot indices, futures, spot metals, and spot energies using the MT5 platform.

Know what Axes has in store for its client traders by gleaning through this broker review.

Axes Background & Safety

Axes was established in 2018 offering Contracts for Difference (CFDs) on several asset classes. In 2020, Axes LLC is approved by Saint Vincent and the Grenadines Financial Services Authority (SVG FSA) to serve as a financial and monetary intermediary in the conduct of financial and monetary brokerage for the selling and purchase of currencies and in the brokering of transactions on the money market.

Axes LCC operates in the U.K. as it is also regulated by the International Financial Market Relations Regulation Center (IFMRRC), a noncommercial organization established to regulate the quality of services provided by brokers, dealing centers, as well as the reliability of services provided by participants of the cryptocurrency market: cryptocurrencies, cryptocurrency exchange markets, cryptocurrency cloud mining services, and companies, which attract investments through ICO.

Being a strong advocate of transparency, Axes observes high standards of safety for its client funds by partnering with major international banks to segregate its client funds from its own funds. More so, Axes LLC is compliant with AML, 4 eyes, EU regulatory framework to ensure transparency, fairness, and security to all traders around the world.

Based on its official site, Axes has over €70.000.000 company capital within its two years of brokerage service. It also has amassed more than 60 international awards for its trading services capped by 6 asset classes offering, <11.06 ms execution speed, and < 7000 orders executed per second. Axes also thrives in its linkages and partnerships as it enjoys 7 global sponsorships.

Axes provides services in over 170 countries around the globe. Its 24/5 customer support is available in 17 languages.

Axes’ official site is not as user-friendly as some of the must-know details about its trading services are not easily found.

Axes Features & Fees

Market Coverage

Axes offers over 250 CFDs covering six asset classes including forex (over 70 currency pairs available), shares (over 150 shares from global companies), spot indices, futures, spot metals, spot energies, and cryptocurrencies.

Account Types

Axes offers three accounts to choose from – Live, Professional, and VIP. The set of perks in upgrading your trading account include up to 30% off spreads with the VIP account, unlimited VPS use, and dedicated account managers. The Live account is best for retail and beginning traders while the Professional and VIP accounts are for experienced and high-volume traders.

Axes offers a demo account wherein a zero-risk environment, you can practice trading strategies. From the broker’s homepage, you can find the registration form for a demo account. A demo account is an excellent way to test before you buy if you’re unsure about the broker.

Using the MetaTrader 5 platform, the Axes MT5 also serves as the trader’s account in which several trading conditions are given. These conditions include micro accounts, fixed spreads, VIP services, 0.37 average market execution, 50% Stop out, no dealing desk intervention, EAs support, and no re-quotes.

Funding Methods

The broker offers several funding options to its clients including bank transfers, VISA, Maestro, Mastercard, Union Pay, Neteller, Paypal, and Skrill. Axes made funding and withdrawal of funds even easier with the Axes Wallet.

Axes does not charge deposit and withdrawal fees for bank wire transactions. However, the sending and correspondent bank may charge according to their own fee structure.

Promotions

This is Axes’ missing link in its services so far. The broker, as of now, does not offer any promotions to its traders.

Axes Trading Platforms & Tools

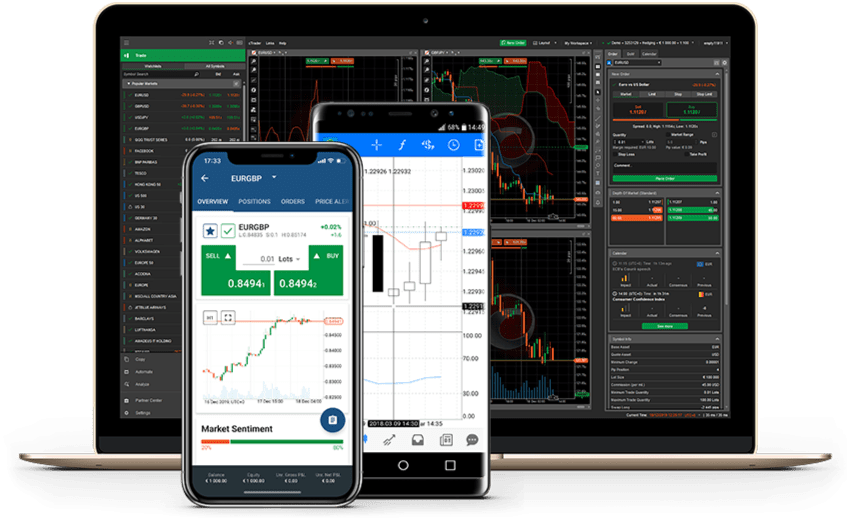

Offering the MT5 platform, Axes offers four versions of it including MT5 PC, MT5 iPhone, MT5 Web, and MT5 Android.

MetaTrader5 is known as a ‘netting’ platform by default, which means hedging is not allowed when using this platform. However, Axes provides a platform with its own hedging version which is available upon request.

MetaTrader 5 Web is easily accessible from all major browser types. Users can access all the same features as the desktop version which includes more than 50 customizable indicators and charting tools. The MT5 Web version is accessible straight from Axes’ site using your login details.

Axes houses a range of educational materials and resources including Basics (of trading), fundamental analysis, technical analysis, psychology, trading tests, video tutorials, and webinars and events. For research, the broker has economic calendar, earning calendars, market holidays, Axes market news, and technical analysis by Trading Central.

Bottom Line

Axes offers a pretty decent range of financial products in CFDs. Its MT5 offering is available across devices and it has competitive spreads coupled with instant payment options.

In terms of regulation, Axes has a weak regulatory credential being affiliated with low-standard regulatory institutions. Another thing to consider is its lack of client promotions and customer support.