It is no secret that eToro is one of the most marketed and advertised brokerage firms in the trading industry. It is seen by many, (may they be seasoned or novice) as a firm with a positive repute. As this is the case, as evidenced by published reviews across the internet, a great number of investors and traders are in agreement that trading with eToro will likely bring about handsome profit.

With a number of review literature affirming sound trading conditions from eToro, it is easy to see why considering the services of the firm is recommendable. With numerous testimonies already piling up in the brokerage’s favour, the review team had opted to look closely at its many offerings to see why this is the case.

This review is a result of months spent examining eToro’s business operations and the services that it provides, aiming at giving a pointed and informed assessment of the firm’s overall capability.

To achieve this, the review team had looked into the following aspects of eToro’s business:

- The financial authorities that regulate all of eToro’s trading operations

- The trading instruments accessible to clients through the firm

- The trading accounts that clients are allowed to open

- The trading platforms provided for within eToro’s trading accounts

About eToro

Among the brokerage firms that the review team had assessed, eToro remains to be one of the most widely-known and of good repute. It is mostly recognized for its offering of Social Trading and the provision of access to a wide range of assets.

Having been established back in 2007, eToro had already gathered numerous clients across the globe, namely in Australia, Cyprus, Israel, the United Kingdom, and the United States. The brokerage firm had set up its headquarters in 3 places namely, Limassol, London, and Tel Aviv-Yafo.

eToro’s trading activities are being regulated by the Cyprus Securities & Exchange Commission (CySec) in Europe. Within the United Kingdom, the brokerage’s operations are sanctioned by the Financial Conduct Authority (FCA). The firm, in both regions, follow the strict rules and guidelines implemented by the European Union regulator body, the Markets in Financial Instruments Directives or simply, the MiFID.

As it also operates in Australia, eToro, takes cues from the Australian Securities and Investments Commission (ASIC) through its license issued by the Australian Financial Services. eToro is also being regulated by the Corporations Act (Commonwealth). This allows clients from different regions to gain access to services provided by eToro Europe.

To date, the brokerage had already gathered millions of clients across 140 countries.

Offers and Services

Accessible Trading Instruments

eToro permits access to 5 asset classifications:

- Commodities

At the time of writing, eToro only trades Commodity CFDs. The trading of such allows the selling for short positions. The trades are leveraged and are given fractional ownership.

- Cryptocurrencies

When an investor buys cryptocurrencies through eToro, it means he or she is investing on the digital coins’ underlying assets. eToro holds these assets for the trader as the trading transaction is unleveraged. However, traders must note that the buy and sell of underlying assets are not regulated, thus posing a risk to its investors.

- Foreign Currency Pairs

As with the Commodities that it gives access to, eToro only trades Currencies as CFDs. Hence, traders need not purchase the underlying asset to be given the capability of trading them. And just like with Commodities, short position sells are also allowed with leveraged trades.

- ETFs

When traders invest on ETFs through eToro, it means that the traders are opening a buy and the position is not leveraged. It means further that the trader is investing not necessarily on the ETFs but on the underlying asset. Regardless, the ETF is held under the trader’s name.

- Indices

Like with the Commodities, Cryptocurrencies, and ETFs, Indices are also traded through eToro as CFDs.

- Stocks

Stocks are bought in eToro through a position that is non-leveraged. The Stock is still held under the trader’s name.

Available Trading Accounts

The first thing that the review team had noticed regarding eToro’s available trading accounts is that these are considerable departures from what other firms usually provide. eToro provides only two types of accounts: the Retail Client Account and the Professional Client Account.

The Retail Client Account provides all of eToro’s offered trading instruments with all these allowed for the execution of Copy Trading. However, Leverage is restricted from these. What is notable about the Retail Client Account is that through this the firm’s clients are given particular protection remedies through the Investor Compensation Fund. On top of that, eToro provides Negative Balance Protection with restrictions on margin closeout.

The Professional Client Account was developed for those who are tagged and proclaimed as Professional Clients, meaning the more seasoned traders, ones who have already built strong investment portfolios. The only thing that might throw interested parties off is that with Professional Client Accounts, specific ESMA protections such as the Investor Compensation Fund and an aid offered by the Financial Ombudsman Service are waived.

Professional Client Accounts are still availed of Negative Balance Protection. Through this system, eToro takes the client’s loss and resets the Equity. A leverage of up to 1:400 is also provided with clients who receive reduction with the current margin rates.

Offered Trading Platforms

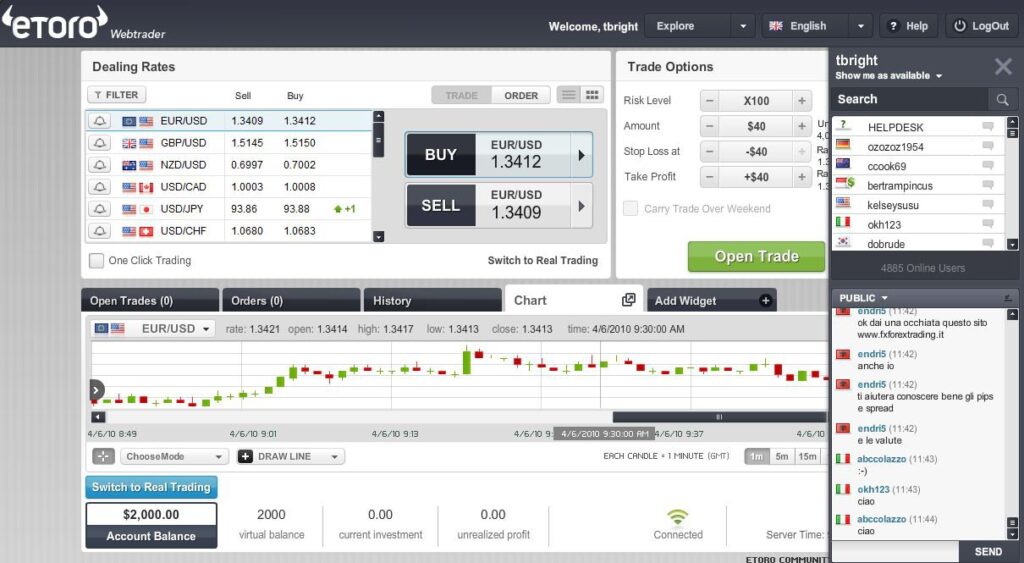

One thing that eToro is lauded for by both the trading community and the review team is that firm offers its own trading platform to its clients. The trading platform is a multi-asset platform that permits its clients to trade more than 2,000 financial instruments.

The access that eToro provides is direct, especially with Stocks and Cryptocurrencies. The fees that the firm charges are seen to be of low cost. In addition, Copy Trade portfolios are made automatically available to its clients.

Trade with eToro Today!

With everything that had been discussed in this review, it is easy to explain why signing up for eToro’s service is more than commendable. Over the course of the months spent with the brokerage, the following facets had been noted and assessed:

- The three the financial authorities considered to be top tier that serve the cause of regulating eToro’s operations

- The wide range and number of trading instruments that eToro’s gives access to its clients

- The trading accounts made available with respect to the client’s level of experience

- The proprietary trading platform that eToro provides that holds numerous trading tools and instruments

- eToro’s provision of Negative Balance Protection on margin closeouts through the Professional Client Account and the Retail Client Account