Coinbase Prime makes use of cold storage for the majority of digital assets, that means they’re held offline and are less vulnerable to hacking. They also adhere to global regulatory obligations and use commonplace security measures like two-factor authentication. For specific particulars about insurance, it’s finest to contact Coinbase Prime directly. Selecting the proper prime dealer is vital to your funding success. This ensures you choose a dealer that meets your wants and objectives.

These services may help ensure they operate efficiently and generate income. That Is why hedge fund managers ought to select their prime brokers fastidiously. In addition to core lending, prime brokers additionally offer concierge companies. These additional providers are designed to ease and enhance the operation of a hedge fund, together with threat and performance analytics. Prime brokers often associate with threat management service suppliers, such as RiskMetrics Group, to provide their hedge fund shoppers with daily threat and performance analysis providers.

The data herein is provided for informational purposes solely. J.B. Maverick is an energetic dealer, commodity futures dealer, and stock market analyst 17+ years of experience, along with 10+ years of experience as a finance writer and e-book editor. This exhibits their dedication to transparency and excessive requirements of their companies. I wish to be taught more about State Street’s merchandise and options.

Contacting Coinbase Prime instantly is really helpful for details on their specific compliance measures. For even more granular information, Coinbase Prime users prime custody can use the API to see pockets transactions, including on-chain transactions made with the Prime Onchain Pockets. You can filter these transactions by specific time frames, providing you with higher management over monitoring and reporting.

Some bigger hedge funds opened full custody accounts for the first time. The broker-dealers that survived the crisis of 2008— particularly, Goldman Sachs and Morgan Stanley—even turned themselves into banks. They also developed in-house ring-fencing options to staunch the outflow of property, largely by re-naming or re-marketing or re-designing their current belief firm solutions, or including something related in Europe and Asia. “Post crisis, clients needed to maneuver unencumbered assets away from the dealer supplier and needed to use custodians to carry out this service,” says Joe Davis, managing director of prime brokerage at Morgan Stanley in New York. “Clients wished to diversify their danger.” It was on this febrile ambiance that “prime custody” entered the lexicon of the hedge fund business.

It has advanced features, higher charges, and a steeper studying curve that aren’t perfect for casual traders. You’re probably higher off with the regular Coinbase platform or Coinbase Pro, depending on your experience. Id verification is central to Coinbase’s regulatory compliance. They use a robust system to determine suspicious customers, as detailed in their blog publish on identification verification. This process follows the Financial Institution Secrecy Act, requiring Coinbase to confirm identities, hold transaction information for five years, and report sure transactions. We purpose to be the most revered monetary services agency in the world, serving firms and people in additional than 100 nations.

A clearing broker is answerable for the clearing and settlement of trades, making certain that transactions are processed correctly and efficiently. Clearing brokers act as intermediaries between consumers and sellers, handling the transfer of securities and funds to finish trades. They play a vital role in sustaining the soundness and integrity of the financial markets by lowering counterparty danger and making certain that trades are settled on time. Whereas prime brokers and custodians each play important roles in the financial industry, they serve totally different features. A custodian is primarily liable for the safekeeping and administration of purchasers’ securities. Custodians present custody companies, which include holding securities in a safe surroundings, managing company actions, and guaranteeing accurate record-keeping.

Direct entry lending Leverage our seamless peer-to-peer model, supported by the operational effectivity and experience of a managed securities lending solution. Segregated custody Easily borrow and finance securities utilizing your segregated custody account, which minimizes credit score danger and offers you a transparent view of your property. Shoppers sign a prime brokerage agreement detailing what duties the prime dealer will assume in offering their companies, along with their relevant charge construction. The relative dimension or success of prime brokerages can be measured in a number of methods. Goldman Sachs, JP Morgan, and Morgan Stanley are the highest three prime brokers. Potential buyers in a hedge fund can also be influenced by the number of a specific prime broker—either positively or negatively.

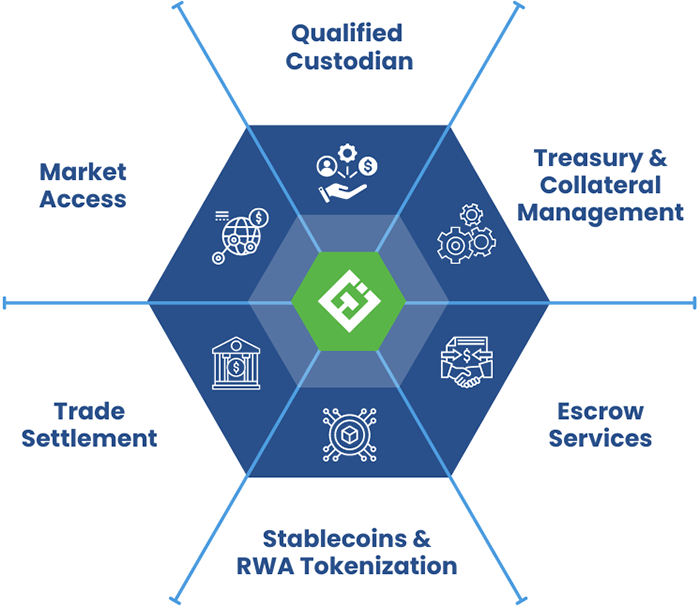

What prime custody principally does is provide a single interface — a one-stop portal — for the multiple and disparate services concerned in prime brokerage and custody. “It makes full sense, and our financial institution is in a position to offer it,” says Devon George-Eghdami, head of JPMorgan’s prime custody group. More hedge funds are answering their clients’ calls for long-only investments. Traditional asset managers, in the meantime, are including long–short strategies. And buyers are still jittery postcrash, even without all of the function switching. Profit from cross-asset class financing for your portfolios of securities and synthetics, securities lending, bespoke financing options, and different companies together with capital introductions, consulting and hedge fund industry data analysis.

Our Clients

Prime brokers make monetary transactions easier by covering all commerce and settlement needs. They guarantee trades are carried out correctly and transactions are processed with out mistakes. This helps keep away from delays and errors, making the market move higher.

Understanding Prime Brokerages: Key Functions, Variations, And Importance

“Assets are totally segregated and held outdoors the custodian’s balance sheet, serving to to address investor issues concerning counterparty threat,” Lewin stated. Ariel Eiberman is the marketing lead at Cryptoworth, a leading crypto accounting software program that helps web3 accountants pace up month-end closing. He has greater than 6 years of expertise in product advertising for software companies and a background of organizing olympic video games and polyglot meetups in a quantity of cities.

- The financial institution at present reports in excess of $140 billion in prime custody belongings.

- This is essential for funds eager to grow and take a look at new investment methods.

- It can enhance both earnings and losses, making it key for daring funding plans.

- It permits hedge funds to borrow securities to engage briefly selling, arbitrage, and other buying and selling methods.

- The system automatically scans multiple exchanges and routes orders to the venue with essentially the most favorable worth.

This suggests the growing acceptance of cryptocurrencies in traditional finance, which could further benefit platforms like Coinbase Prime. Coinbase Prime prioritizes the security of shopper property via cold storage. This means most crypto holdings are stored offline, significantly lowering the chance of hacking. While Coinbase doesn’t publicly share its insurance coverage details on its website, its institutional-grade custody answer is a core function, suggesting sturdy protections.

Prime Providers

This give attention to best execution helps establishments get optimum value for his or her trades. This automated process improves entry to liquidity across varied buying and selling platforms. Purchasers can execute trades efficiently without pre-funding accounts or the chance of missing market opportunities. This streamlined strategy to trading and liquidity administration is a key benefit for institutional buyers utilizing Coinbase Prime. You can learn extra about Coinbase Prime’s brokerage companies in this Blockworks article. Prime brokerages present many essential services to hedge funds.

This could be an important issue in the determination, especially for a new fund that is just starting up and actively looking for major investors. They offer a variety of services to help clients via trading and settlements. If you’re a person investor or newer to crypto, Coinbase Prime isn’t the best platform for you. Its advanced options and institutional focus translate to a steeper learning curve. Casual merchants will likely find the platform’s complexity unnecessary.

“The prime dealer has no claim on the belongings in the belief vehicle” he stresses. “We went to UK and US counsels concerning the bankruptcy independence of the nationwide bank subsidiary and its connection to the US/UK broker sellers. “We have addressed any operational risk posed by the establishing a secured house away from our facilities that would help the in the unlikely event of a enterprise interruption at Morgan Stanley” he explains. “Custodian bank staff have entry to the house which has devoted and unbiased technology to permit for communication with our purchasers.