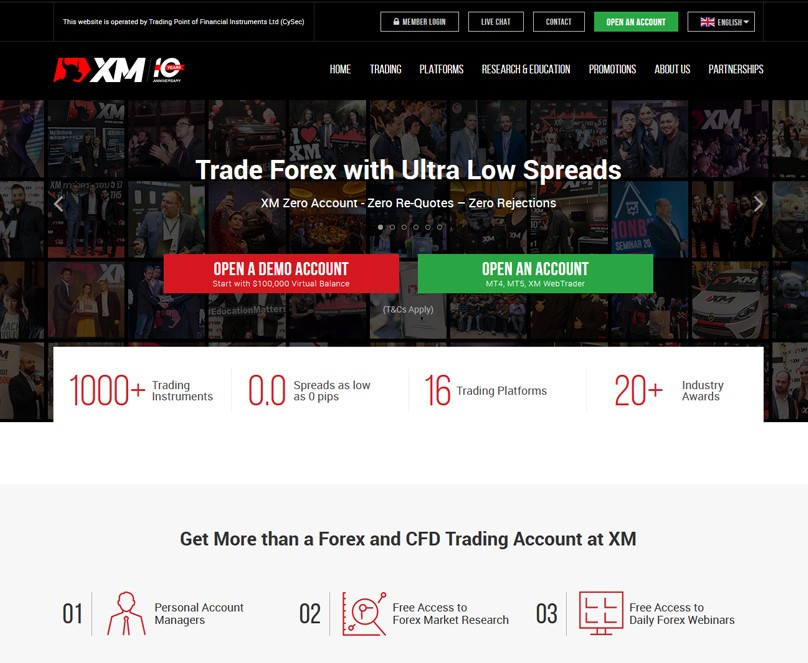

Trading Point Holding, a multinational provider of Contract for Difference and Foreign Exchange trading, launched XM as its financial solutions platform in 2009. The parent company’s two flagship brand, XM and Trading.com, are well-known in the industry for their optimum services and conditions.

Currently, XM has 1.5 million subscribers from over 196 countries. The company’s consistent execution of its objective, which is to have a fair and friendly trading service, led to its remarkable business momentum. Moreover, its excellent customer service, personalized assistance, and versatile investing choices are all contributing factors to its rising industry appeal.

XM Platform Selection

XM is a MetaTrader-based trading platform. Since these two are the most common platforms in the financial sector, the company’s use of MT4 and MT5 has resulted in tight market traction. Stop, cap, market, and trailing orders are supported by the former, which is advantageous for retail traders. As for the MT5, it is a multi-trading update that allows clients to trade a wide range of financial instruments. Both platforms are adaptable, as they can run on a variety of platforms, including iOS, Android, and Windows.

Trading with XM is made easier by the fact that it has a smartphone equivalent. Its mobile version is known for its simplicity, thanks to its one-click trading feature. Furthermore, the device is protected by fingerprint authentication, which adds an extra layer of security to the traditional pin code. It is available in the Apple App Store and Google Play and can be downloaded without difficulty.

XM Advantages and Disadvantages

For those who are interested in subscribing to XM, they would find the registration process convenient and efficient. Clients may also benefit from fair prices as well as a diverse set of educational and research resources.

If we are to talk about some of its downsides, the company’s restricted asset groups for portfolio upgrade seem to be undesirable. Add to that are average foreign exchange and stock index rates, which are marginally higher than what most brokers typically bid. Lastly, the lack of investor protection, which protects EU-based clients from potential financial risks, comes as a significant drawback.

XM Bonus and Incentives

XM’s fun bonuses and promotions are one of the many impressive features that customers would undoubtedly appreciate. It comes with a free VPS (virtual private server) that speeds up trading transactions around the world 24 hours a day, seven days a week. It also takes pride in having a low commission fee and no fees for withdrawals or deposits. However, since its EU office is controlled by ESMA, it is required to follow the authority’s bonus prohibition, rendering its $30 deposit bonus inaccessible to European Union traders.

XM Account Selection

XM provides four account types. The Micro, Ultra-Low, Standard, and Zero accounts all operate on a tiered system, allowing a multi-level trading experience that caters to a wide range of traders.

Micro account- XM’s entry-level account has a minimum funding of $5. Conditions covered by this fee includes a wide range of tradable currencies. More impressively, it only charges 1 micro lot for 1,000 unit of any base currency.

Ultra Low Account- Talking about trading conditions, most of what is offered in this account bears similarity Micro account’s. It has the same set of tradable base currency, only that additional trading offers are made premium. As such, it then has an increased amount of $50 for its minimum deposit.

Standard Account- This account is particularly integrated with all the trading conditions offered in the first two accounts. To state, it is just a hybrid of both the Micro and Ultra Low account, and it does not provide any outstanding functions or features for that matter.

Zero Account- This account needs a $10 deposit. With an amount higher than what is required in the entry level, it is disappointing that it only offers three base currencies. Its trade size does not come impressive at all as it has the same set as the abovementioned.

Customer Support

The responsiveness of XM’s customer service is one of the company’s strengths. Non-English speaking customers can choose from a range of languages. It offers multiple ways for customers’ queries, including email, phone, and live chat, which is available 24 hours a day, seven days a week. . However, on the downside, its live chat takes longer to answer each time a new query is sent. Although it provides fast resolutions, answers remain inconsistent.

Get Involved

As previously said, XM has its own benefits and drawbacks. Although XM has some redeeming qualities, it also needs to improve on some of its flaws, such as its insurance and compensation schemes. Furthermore, since there are certain parallels between the accounts, its uniformed account collection prevents clients from selecting the right one. However, if we look beyond these, XM will still be a good brokerage firm worth investing in.