OANDA is a US-based global corporation offering a broad range of financial products including currency pairs, indices, metals, commodities, and bonds. Its trading system is powered with award-winning forex and CFD trading platforms.

Discover unique services, features, and offerings of OANDA and know the benefits of trading with a global broker by reading this broker review.

OANDA Background & Safety

Founded in the United States in 1996, OANDA started as an IT firm which was recognized as the first company to share exchange rate information on the internet for free and was featured in Time Magazine for its revolutionary move after its inception.

In the year 2000, the firm introduced a trading platform that helped pioneer the development of Internet-based currency trading around the world, enabling forex investors to trade the markets with as little as $1. OANDA continued to author several trading innovations and solutions including the Bill of Rights, market commentary, and pipettes.

From there, OANDA started getting more recognized by institutions and award-giving bodies internationally. Some of these awards include “Best Retail FX Platform” by eFX awards, “No. 1 Forex Broker in Singapore”, and “Highest Overall Client Satisfaction” from Investment Trends – US Foreign Exchange Report 2017-2018.

At present, OANDA has 8 offices in 8 different countries across Asia, Europe, and North America. These countries include Singapore, Australia, Japan, India, UK, Germany, Poland, and USA. OANDA Group is also regulated by 5 major regulatory authorities around the globe including the Investment Industry Regulatory Organization of Canada, Financial Conduct Authority, and Australian Securities and Investments Commission (ASIC).

In its ultimate course, OANDA was acquired by CVC Capital Partners, a private equity firm that presently manages over $70 billion in assets around the world. The firm also has outstanding partnerships with other global companies including Google, FedEx, and Airbnb.

OANDA Features & Fees

Market Coverage

With just a little over 100 financial instruments, OANDA seems to fall short of covering the financial markets, considering its global status as a trading service provider. It covers currency pairs, commodities, metals, indices, and bonds.

Account Types

In this aspect, the broker also features less than expected, having only two account types to offer its clients. Let’s dig deeper into the trading conditions included in each account type to see if the broker is implying less is more.

The Standard Account provides access to the broker’s covered financial markets capped by 70 currency pairs. The account is also powered by the institutional-grade execution (less than 1 millisecond on V20 platform). It can be any trader’s account as it requires no minimum deposit amount and access to all trading platform offerings. In terms of quality of trade execution, the account is armed with a fully automated execution with no requotes. Other features covered in the use of this account include 24/5 customer support, variable contract sizes, OANDA trading performance analysis dashboard, and every 20 minutes update of MT5 open order indicator.

The Premium Account is for the more privileged traders as it requires at least a $20,000 minimum initial deposit. The account can access all liquidity markets provided by the broker as well as the use of any trading platform. The account is also powered with institutional-grade execution, a dedicated relationship manager, unlimited free wire transfers, no requotes, and full automation of trade execution. The account is also into 24/5 customer support, variable contract sizes, and the OANDA trading performance analysis dashboard. Every five minutes is the updating of MT5 open order indicator and users are treated as priorities during services queues.

Both account types can be modified into joint and corporate accounts.

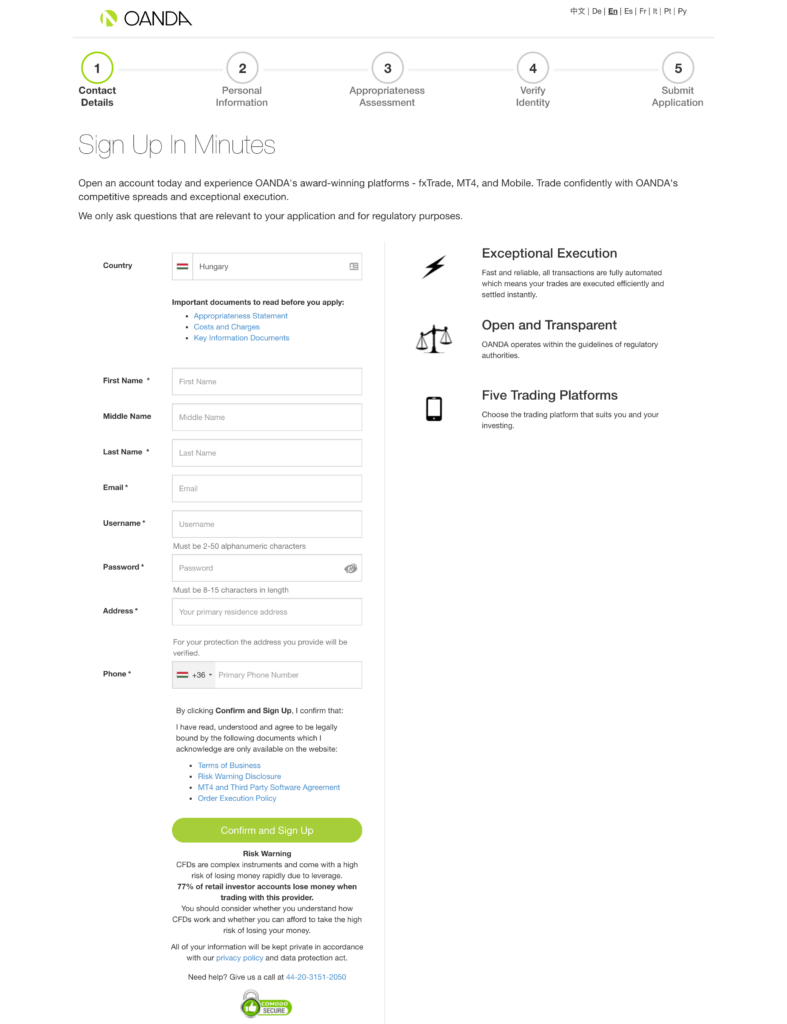

Account Registration

To open an account with OANDA, you just have to register through its online registration form.

Funding Methods

OANDA accepts various methods of payment including VISA, Mastercard, Skrill, Neteller, and Maestro. The broker is also amenable to bank and wire transfers.

OANDA Trading Platforms & Tools

OANDA has extensive research tools for forex and CFD trading as it houses several functionalities including advanced charting, OANDA technical analysis, OANDA Algo lab, industry news, and economic event relay.

For its offered platforms, OANDA has Web Trading Platform, Desktop Trading Platform, mobile trading apps, and MetaTrader 4.

OANDA’s own trading platforms are available in several languages, have advanced charting tools, and are user-friendly and customizable. However, the broker’s own platforms do not have price alerts. More so, its mobile platform app has the same features as that of the web platform. They are available on iOS and Android devices.

For its MT4 offering, OANDA has added the OANDA VPS Provider to reduce latency further. It also has Proprietary MT4 Plug-In that includes intraday market scanning, automatic chart pattern recognition and pattern quality indicators, automated alerts for specified patterns, and the ability to execute trades directly inside the interface.

Bottom Line

OANDA is an industry leader in terms of providing innovative trading solutions and extra trading services. It also showcases dependable trading platforms with a digital account opening process. Traders also benefit from the trader’s extensive research materials.

However, the broker has a small range of financial instruments being a global firm with just over a hundred tradable assets. Bank fees for withdrawals are also costly for the part of clients.